Policy directions and specifications for KSeF-related changes to VAT act

The Finance Ministry has published policy directions and specifications regarding changes it intends to make to the VAT Act to finally implement KSeF (National E-Invoicing System) as a mandatory scheme. The document is a product

Government adopted proposed legislation implementing DAC7

On April 9 the Council of Minister adopted a proposal dated 27 March 2024 to amend the Tax Information Exchange with Other Countries Act and certain other acts ("Proposal") with a view to implementing EU's

Supply chain true-ups under profit split method vs. transfer pricing adjustments

This is to let you know of a recent private tax ruling dated 28 March 2024 by Director of National Revenue Information ("Authority") (ref. 0111-KDIB1-1.4010.34.2024.2.SG), where he upheld the applicant's argument that an annual profit/loss

WTS Global News

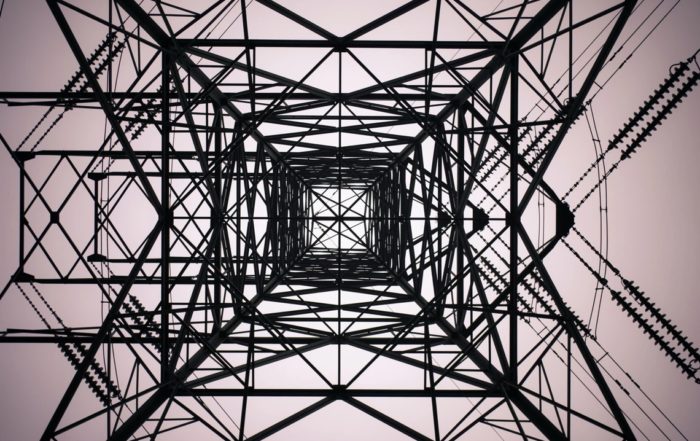

Roundtable: The role of energy and electricity taxes in the current energy crisis – Views from France, Germany, Portugal and Sweden

WTS Global is pleased to invite you to participate in an exciting virtual roundtable on the topic of the role of energy and electricity taxes in the current energy crisis. Tax professionals from French, German, Portuguese and Swedish WTS Global member firms will

Operational Taxes for Banks Conference

Industry solutions for the latest regulatory and operational tax challenges for banks We cordially invite you to the Operational Taxes for Banks conference which will take place in London on 25 May 2022. WTS Global is the lead sponsor of the conference.

ITR Indirect Tax Forum

We cordially invite you to the ITR Indirect Tax Forum which will take place in Brussels on 10 & 11 May 2022. As in previous years, WTS Global is again a lead sponsor of the conference The evolving European