Tackling Plastics Pollution and Waste at the global, regional and national Levels

On 2 March 2022, 175 member states of the United Nations (UN) endorsed a resolution at the fifth session of the UN Environment Assembly in Nairobi to create an intergovernmental negotiating committee to commence work on crafting a legally binding international agreement by the end of 2024 to tackle plastics waste and pollution. While details of the exact scope of this “plastic treaty” have yet to be delimited, it is significant that the UN resolution has received strong multilateral support – crucially, from major plastic-producing member states such as the United States and China – and, if signed and ratified by the UN member states, the treaty promises to be a landmark, first-of-its-kind global agreement designed to address the full lifecycle of plastic, including its production, design and disposal, with the stated objective of reducing plastic waste and pollution.

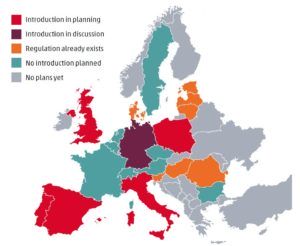

This decisive step taken by the international community is the latest in a series of initiatives undertaken by different groups and countries that acknowledge the scale of proliferation of plastic waste in recent decades and the significant environmental dangers presented by plastic pollution. In Europe, the issue of plastic packaging waste has been at the forefront of policy thinking at the regional and national levels. On 1 January 2021, the European Union (EU) introduced a levy based on the amount of non-recycled plastic packaging waste produced by each EU member state (Member State). This “plastic levy” is designed to reduce the proliferation of non-recycled plastic waste while concurrently funding the 2021-2027 EU budget against the backdrop of the increased spending from COVID-19. Each Member State is required to pay a levy determined by multiplying a rate of EUR 0.80 per kilogram to the weight of non-recycled plastic packaging waste. While some Member States are currently paying the levy out of their national budgets, others have introduced (or are looking to introduce) new taxes, duties, charges, fees or contributions on plastic products or have already extended (or are considering extending) existing schemes to tax plastic products as well. Additionally, some non-EU European countries have also begun to target the use of plastic products in a bid to cut plastic waste and move towards a circular economic model.

Plastic Taxation in the EU:

Different Approaches to financing the EU Plastic Levy

Among the Member States that have implemented some kind of plastic tax, the tax design varies greatly. Some are focusing on packaging (i.e. both plastic and non-plastic packaging), while others are narrower in scope, targeting single-use or non-reusable plastics only. Some Member States are imposing a tax on domestic and foreign sourced plastic products, whereas other Member States are relying on an excise tax mechanism to exclusively target foreign sourced plastic products. The list of exempt products also differs from one Member State to another. Crucially, the rate of tax varies across Member States, with some choosing not to levy a tax altogether.

What has emerged is a patchwork of uncoordinated national rules that necessitate careful examination and navigation by enterprises operating in multiple Member States. Seen from this angle, harmonised EU plastic tax legislation to streamline the existing national plastic tax regimes will undoubtedly be a major labour-saver for enterprises and will be welcomed.

Despite its appeal, the introduction of an EU-wide excise duty is not straightforward given the principle of unanimity in tax matters under EU law. The Member States will have to agree on uniform tax objects, taxable events and (minimum) tax rates. As the volume of plastic waste and recycling rates differ substantially from one Member State to another, a lengthy process of negotiations and compromise will be expected before an EU-wide agreement can be reached. Moreover, the Member States will also have to unanimously agree on adjustments to a plastic tax directive. The difficult and prolonged negotiations underpinning the revisions to the Energy Tax Directive provide an indication of the challenges of embarking on such an ambitious undertaking particularly since there is an absence of consensus on whether or not to tax plastic products and, if so, the kind of plastic products to tax.

Finally, in line with EU law’s subsidiarity principle, the Member States should, as a starting point, be allowed to determine the most appropriate measures to implement at the national level to reduce plastic packaging waste, and so intervention by the EU in this field should not be a first resort. In light of the above, harmonisation of plastic taxation rules across the Common Market, while desirable, appears to be an unlikely prospect in the foreseeable future.

Introduction of Plastic Taxes in Europe

Challenges for Enterprises

Enterprises will do well to stay abreast of developments and track the evolving regulatory and tax landscape so as to ensure that they do not fall afoul of the applicable national rules and are not subject to enforcement proceedings or financial penalties for non-compliance.

In terms of business operations, the existence of a plastic tax can have wide ranging implications on an enterprise’s internal processes and procedures. As a preliminary step, the enterprise will need to familiarise itself with the types of plastic tax that are levied in each country in which it operates and ascertain which of its local entities is liable to pay the tax.

Depending on which entity within the supply chain is liable, there may be invoicing and pricing implications to consider. Thereafter, the enterprise will need to identify the employees responsible for handling compliance and provide such employees with relevant training to enable them to adequately perform their duties. The enterprise’s tax and legal departments must also be prepared to support the additional compliance obligations. The enterprise must also be able to single out the types of materials or products that are subject to tax from within its supply chain and its enterprise risk management systems must also be adapted to handle these compliance requirements.

To help companies make sense of this rapidly-growing area of taxation, WTS Global has invested in building up its competence and expertise in this field to provide both national and cross-border support. This current report serves as a reference to aid companies in navigating tax issues arising from the manufacture, importation, distribution or use of plastic products, and also to initiate deeper thinking on how plastic value chains can become more circular.

Overview of the State of Implementation

Click on the country name for a summary of some of the significant measures proposed or adopted by European countries (including Member States) to impose a financial cost on the use of plastic products.