The Norwegian Tax Administration is modernising its VAT systems

The Norwegian Tax Administration is modernising VAT reporting and developing a new automated VAT register and a new solution for reporting transactional data

The Norwegian Tax Administration is modernising its VAT systems and so businesses who are established and registered for VAT purposes in Norway are going to see changes in VAT reporting and certain other aspects. This modernatisation process started in 2019 and is planned to be finished by the end of 2023.

The key modernisation points are:

- Increasing compliance with the rules for taxes and duties;

- Reducing the extent of the ‘hidden’ economy;

- Making it easier for business in duties regarding VAT.

With its MEMO Project, the Norwegian Tax Administration is developing a new digital VAT return. The tax authorities have already completed a new solution for registering entities in the VAT register and are currently developing a new digital VAT return.

The new digital VAT return will be launched and ready for use from 1 January 2022.

From this date, VAT returns will have to be submitted in the new format. To transition to the new VAT return system, companies who currently submit VAT returns through their own technical systems must check if it is necessary to make changes to their technical interface.

The new VAT return will re-use the Standard Tax Codes from the SAF-T Standard. The numbered fields will be replaced by a dynamic list of specifications. The electronic forms will be replaced by digital interactions.

The thinking is that it will be easier to supply correct information when using the digital VAT return since it will be possible to apply remarks by using attachments both per line and at the end of the form. The new VAT return will cover more cases, and will strive to remove the need for remarks. For common cases, structured remarks will be made. It will be possible to attach up to 50 files of a maximum of 25 MB per file per VAT return.

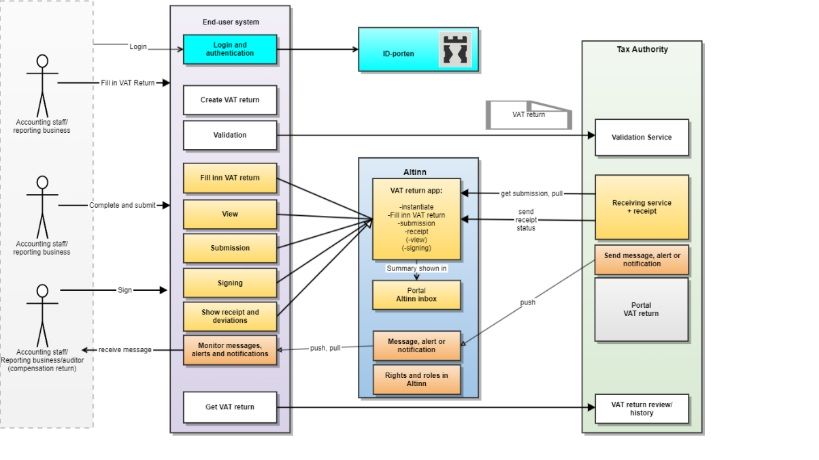

When submitting VAT returns digitally the authentication will be carried out through ID-porten and with a personal login.

Businesses are encouraged to deliver their VAT returns directly from their ERP system. For those businesses who are not able to deliver their returns through an ERP system, a portal will be developed for submitting the VAT return. Altinn will still be used for identification and information exchange.

Finally, the Norwegian Tax Administration is working on a new solution for reporting on sales and purchases. The Tax Administration believes that such reporting on sales and purchases will help both businesses and the Tax Administration to ensure equal treatment and prevent unlawful distortion of competition for businesses.

The proposal will require changes in legislative acts and regulations, and the Ministry of Finance is currently reviewing the Tax Administration’s proposal.

Illustration describing the architecture of the new solution Frontpage

Source: Norwegian Tax Administration (skatteetaten.no/nymva)

Download Newsflash: The Norwegian Tax Administration is modernising its VAT systems